by Representative Lauren Necochea and Rep. James Ruchti

We came into this session with high hopes for what we could accomplish for Idahoans. Our strong revenues meant we could finally deliver broadly shared priorities that have been on the back burner for too long: reducing property taxes, repealing the sales tax on groceries and strengthening our schools. Last year’s lopsided tax bill favored profitable corporations and people at the top of the income spectrum. This could be the year we focus on working families. After all, local economies depend on a thriving middle class.

We were disappointed to see our high hopes dashed so quickly when the GOP rushed to advance House Bill 436. In doubling down on the trickle-down approach from last year, Republicans are closing the door on important policies Idahoans want.

It is past time we prioritize working families. Every major tax bill the Legislature has passed for more than a decade has prioritized profitable corporations and people at the top of the income spectrum. We must balance this out by focusing on the needs of everyday Idahoans, such as repealing the sales tax on groceries, increasing property tax assistance and using state funds to plug the holes in school budgets that must be filled by supplemental levies paid for with property taxes. With a $600 million price tag, HB 436 will gobble up dollars we need to deliver far more critical tax solutions.

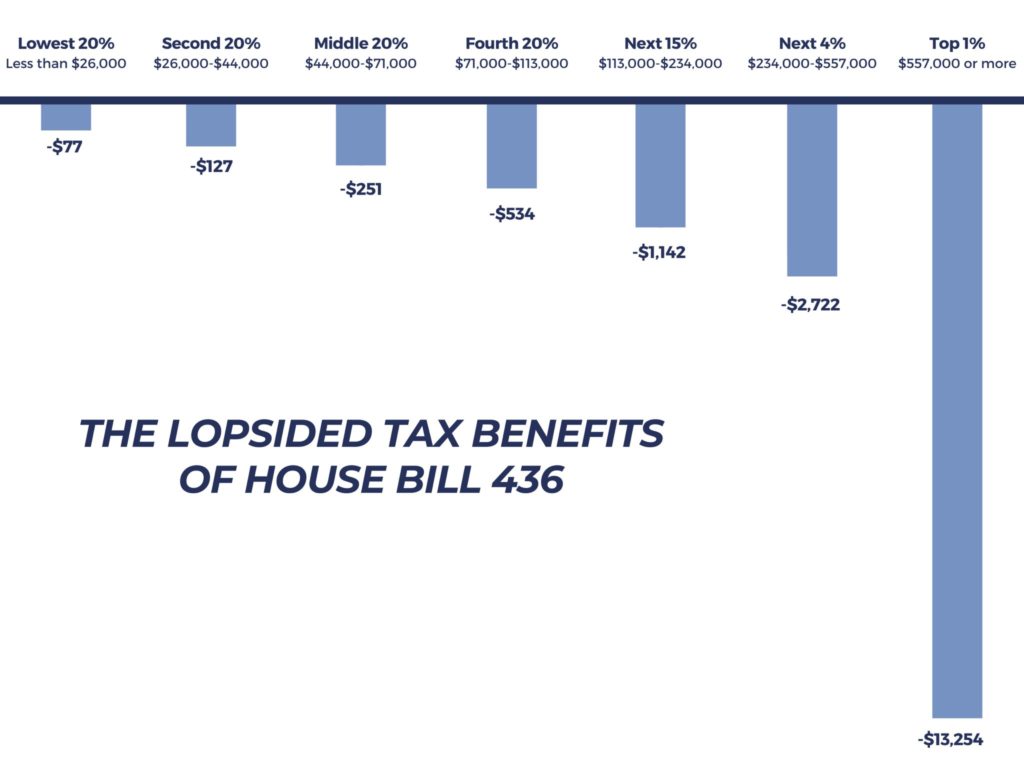

Just like last year’s tax bill, the benefits of HB 436 are completely lopsided. The priorities of GOP legislators are upside down when they want to send $8,000 checks to households in the top 1 percent and $75 to Idahoans who work for modest wages. The ongoing tax benefits follow a similar pattern. The top 1 percent will receive an ongoing yearly tax cut of $5,000, on average. Idahoans with modest incomes will receive little to no ongoing benefit.

We should instead be putting more dollars in the hands of working families. This is not only popular among Idahoans, it is better for our economy. Working Idahoans power our local economies when they buy groceries, get an oil change or have their hair cut. Small businesses depend on a strong middle class to thrive.

What we do not need are more tax cuts for profitable corporations. HB 436 would result in the lowest corporate tax rates of this century, landing at just 6 percent. Yes, corporations would pay the same tax rate on their profits that regular Idahoans pay in sales tax on food, diapers, medicines and other necessities.

Bad economics aside, this bill is troubling in another way. As we write this, we are still receiving emails from regular Idahoans asking us to oppose HB 436 and instead reduce property taxes, repeal the grocery tax and make sure schools are well funded. Neither of us has been contacted by a single constituent asking for this bill. Even in committee, every constituent who testified opposed it. Only lobbyists testified in favor.

Our political system is seriously broken when the GOP supermajority rams through a bill that voters are asking us to reject. We don’t believe the Legislature has ever thrown such a hefty sum of money ($600 million) at something Idahoans clearly don’t want. Idahoans deserve better. They deserve leaders who will listen and deliver the policies they support.

We have a once-in-a-lifetime opportunity to make the state of Idaho a place where working families can thrive and live their best lives. Let’s use the dollars available to provide meaningful tax reform to working Idahoans and improve our schools. Let’s do what Idahoans are asking us to do.

– – – – – – – – – – – –

Rep. Lauren Necochea, D-Boise, serves as the assistant Democratic leader in the Idaho House and is in her second term representing District 19. Rep. James Ruchti, D-Pocatello, was elected to the House in 2020 and represents District 29. He previously served in the body from 2006-2010. Both are members of the House Revenue and Taxation Committee.